KeywordsCOP21 ESG Green Bonds Sustainability

JEL Classification G11, G12

Full Article

1. Introduction

“We need bold action on climate change. It comes down to a simple choice: we continue with business as usual and hope for the best. Or we act now and build a resilient future. Our generation may not be able to solve all the problems related to climate change, but we can do our part to leave a better planet for the next generation.”

---Kristalina Georgieva (Chief Executive Officer, World Bank)

The goal of a complete decarbonization of the global economy by the end of the 21st century was set at the climate conference in Paris in 2015. A total of 196 countries adopted the United Nations Framework Convention on Climate Change (UNFCCC; Bultheel et al., 2015). In particular, the challenge facing government decision-makers is to cut global warming by 2 degrees Celsius compared to levels before industrialization. In the process, the European Union (EU) has presented its master plan to a sustainable and low-carbon economy and set its decarbonization targets for 2050. Since 2014, sustainable issues have been addressed in fiscal policy by including ESG (Environment, Social and Governance) specifications within Directive 2014/95/EU.

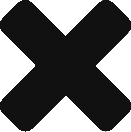

As part of this ambitious agenda, the financing vehicle “green bonds” can help both adapt to climatic change and make the shift to renewable technologies. The construction of the Green Bond as well as the parties involved are illustrated below (World Bank Green Bond Impact Report, 2018, Source: Climate Mundial, 2016).

Figure 1. Paris Climate Bond Concept

Source: own illustration

According to a 2009 academic study, about 10 trillion USD in financing will be necessary by 2030 to finance the achievement of the climate goal (Mackenzie/Ascui, 2009). The global community needs to invest 100 billion USD annually in environmental investments by 2020 to achieve meaningful climate action (Clapp, 2009). The financial and environmental investment required to change transportation and develop new infrastructure is a key concern in the discussion of financing the transition from incumbent fossil fuel-based to environmentally friendly renewable energy technologies, and governments stand an important part to play in establishing standards and pushing through regulations to encourage the emergence of new investments and green business activities (Flaherty et al., 2017).

In particular, the lack of a uniform system of classifying what a green investment actually is has a negative impact on investor confidence. The EU has made initial efforts to establish a European standard for green bonds. This is to be based primarily on recognized market-based guidelines such as the Green Bond Principles (GBP).

In addition to an overview of the market, the various types of Green Bonds, their advantages and problems, this paper gives an assessment (from a financial management point of view) of the benefits of this asset class compared to conventional bonds in terms of a premium for investors. Finally, the asset class is assessed for its future development and whether it is a success or failure.

2. Results and Discussion

2.1. Green Bond Definition

By definition, "green bonds" are fixed-income securities that finance green projects with environmental or climate benefits. However, bond issuers can designate their bonds as "green" without legal restrictions. Only the People's Republic of China (PRC) and India have defined a regulatory and statutory term for what constitutes a "green bond". The PRC, in particular, restricts the use of proceeds from green bonds solely to reinvestment in environmental projects, with two guidelines for monitoring green bonds. On the one hand, the China Green Bond Guidelines and, on the other, the Green Bond Endorsed Project Catalogue adopted by the People’s Bank of China (PBoC) according to the EU.

In Norway, green bonds are required to be listed on the Oslo Stock Exchange in order to receive the green label. The EU adopted in 2016 the example of Norway for the operation of green bonds. Norway also demands that a second opinion on the Green Bond issue be obtained and published.

This allows issuers to qualify bonds as "green" only if they are compliant with the GBP, CBI, or national green bond issuance guidelines and rules. Under the auspices of ICMA, frameworks have been established by major private financial institutions. The GBPs are used to transparently inform potential issuers about the four main essential elements of green bonds:

The use of income from bond distributions.

Evaluation and selection process for project.

Administrative revenue management.

Reporting of the (environmental) impact.

After issuing a green bond that is GBP aligned, issuers must become certified and establish regular reporting. If the proceeds from green bonds are not reinvested in green projects within 24 months, the bonds lose their green bond classification (Petrova, 2016).

2.2. Types of Green Bonds

Green bonds do not exhibit greater complexity than conventional bonds. However, additional information about the environmental impact of the returns is required, which distinguishes them from traditional bonds. Tracking this additional benefit can be straightforward if it is linked to the underlying physical assets or projects. Green bonds often come with so-called "ring fences" so that tracking and reporting can be done on the use of the capital raised. Disclosure of the assets being financed before and tracking and reporting on the use of proceeds after issuance are therefore key factors (Cochu et al. 2016). Comparable to conventional bonds, green bonds can be divided into seven types (Shishlov/Morel/Cochran, 2016):

Corporate bonds

Project bonds

Asset-backed securities (ABS)

Covered bonds

Supranational, Sub-Sovereign and Agency (SSA)

Municipal bonds

Financial sector bonds

2.3. The Emergence of Green Bonds

In 2007, the European Investment Bank (EIB) issued the first green bond. Another green bond issue was subsequently issued by the International Bank for Reconstruction and Development (IBRD) in 2008. The issue was prompted by a group of Swedish pension funds searching for investment opportunities in climate-friendly solutions through the intermediary Skandinaviska Enskila Banks (SEB). The focus was on a high-quality and, above all, liquid investment vehicle that did not involve any additive project risk. In particular, it was important for investors to receive information on the impact of their investments. In this context, the funds are working with the World Bank to develop a new product and as a result the “Green Bond” was created, which was issued in November 2008 and forms the basis for today's green bond market. SEB was the first company to define the project criteria that must apply to a green bond issue. The renowned climate research institute, CICERO, was included as a second evaluator and reporting on the impact of investments was added as an integral part of the process. These framework conditions formed the basis for the Green Bond Principles, which are controlled by ICMA (World Bank Green Bond Impact Report 2018).

“Green bonds” have established themselves among investors since the first issues in terms of sustainability, expediency as well as with regard to the liquidity of the bonds. Particularly also due to their positive impacts on sustainable investments, strong demand has been triggered. For example, over the past 10 years, the World Bank has launched 147 “green bonds” in 20 different currencies with an equivalent value of around 11 billion USD. These investments were intended to decisively promote the shift to carbon-reduced and climate-neutral growth (World Bank Green Bond Impact Report 2018).

2.4. Green Bond Market Overview

Pension funds, insurance companies, fund managers, and other institutional investors invested nearly USD 80 trillion in green bonds. Nevertheless, the share of green bonds in the total bond market is 0.13% (World Bank, 2015). Even though the share of green bonds in the bond market is still very low, there is an increasing demand for green bonds. ln particular, investors, primarily institutional, who need to diversify their portfolios against climate risks and increase the ESG as well as SDG profile of the portfolio, have significantly increased their demand. In 2015, 76% of all green bond issues came from multilateral institutions. The issuers were institutions like the World Bank, the Nordic Investment Bank (NIB) and the European Investment Bank (EIB). Corporates issued 16%. The remaining providers were governments and municipalities with a share of 8% of total issues. In total, the value of bonds with a climate policy impact is around USD 694 billion. The two categories that are distinguished in green bonds are with and without being labelled as green. Labelled green bonds accounted for about 17% of the total market of all climate-regulated bonds in the 2015 CBI report, and 83% for unlabelled bonds. Overall, there is a distinct lack of climate-related bonds and green projects, so that the supply of green bonds - despite the significant annual increase in issuance - is currently insufficient to meet the strong demand from investors. (CBI Report 2015).

2.5. Financial Performance of “Green” vs. Conventional Bonds

In contrast to conventional bonds, green bonds require a review according to the GBPs and the requirements of the CBI. In essence, they are comparable to conventional bonds, especially in the (institutional) primary markets, where bond traders in particular operate and sell green bonds in large volumes to investors who demand green as well as traditional bonds (Östlund, 2015). Market research by Standard & Poor's Ratings Services (2016) concluded that green bond trading is very close to the yield spreads of traditional bonds. Often in the secondary market, the green bond label is also used as a criterion for bond selection. In this context, mandatory green bond issuance guidelines help to ensure that the bonds they buy are truly green.

2.6. Green Bond Premium

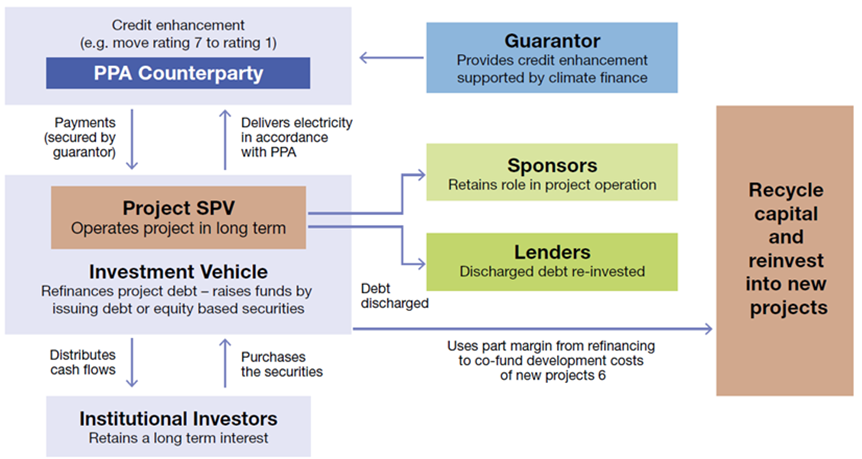

Further the existence of a Green Bond premium has been investigated several times in recent years through studies by scientists. A very extensive study was conducted by Zerbib (2019). For analysis, eligible green bonds were compared to two similar traditional bonds and the exact same terms such as bond currency, assigned credit rating, overall bond structure, their collateralization and seniority, and coupon rate.

The result of the study was a premium of -8bps for Green Bonds compared to traditional investment-grade bonds, -5bps for USD bonds and -2bps for EUR bonds. The causation was attributed to a demand overhang for green bonds.

Further research compared the credit spreads of green bonds to the credit spreads of conventional bonds from the same issuers over the 2014 and 2017 time periods (Ehlers and Packer, 2017). The results of the study showed that bond issuers of green bonds were able to fundraise at lower spreads than conventional bonds. Furthermore, a positive correlation between liquidity risk and spread could be demonstrated (Wulandari et al., 2018). It has also been demonstrated that over time, liquidity risks on the yield spread of green bonds are negligible and, overall, the long-term yields of green bonds are comparable to those of conventional bonds (Barclays, 2015).

Due to a lack of a mandatory standard for identifying "green" bonds, investors must rely on outside evaluators to comply with the verification requirements from the GBP and CBI guidelines The resulting additional transaction costs of issuing green bonds may make them less attractive to investors than conventional bonds (Cochu et al., 2016). Also, the risk profile for green investments is unclear, as primarily green bonds are wrapped debt instruments, not backed by the performance of the underlying green investment, but by the financial performance of the issuers. Significant action is also still needed in terms of transparent reporting for green investments. Green project bonds backed by the financial strength of the underlying green projects could therefore be considered riskier by investors than conventional bonds (Cochu et al., 2016).

Figure 2. Credit Spreads at Issuance of Green vs. Non-Green Bonds.

Source: Board of Governors of the Federal Reserve System; Deutsche Bundesbank; Bloomberg; Ehlers and Packer, Green Bond Finance and Certification, 2017).

2.7. Impact Investing with Green Bonds

There is a growing conviction among investors that climate change is not a theoretical threat but a real one. In particular, the impact of extreme weather and temperature fluctuations, the significant rise in sea levels, but also the scarcity of resources and increasing environmental pollution around the globe show that climate change has lasting and tangible consequences for the population, but also for administrations and companies. Yet, for many investors, climate-neutral or even climate-improving investments are still an abstract concept that is often lumped in with discussions of risk management, consumer preferences, the conflation of ESG/SDG with impact investing. In order to assess the actual impact of green bonds, an ex-post quantification of the reduction results must be carried out and should be based on the Clean Development Mechanism (CDM). A certification analogous to CDM can provide two concrete advantages for the green bond market. First, certification can help identify impact projects more accurately through this project-related test. As a result, net investment in low-carbon transition projects would become more attractive and increase significantly. A second important aspect would be that accurate and transparent quantification of reduction outcomes would help to identify the projects with the greatest environmental leverage and thus make it possible to measure quantity of GHG emissions reduced per dollar invested. This transparency in measuring impact would help maximize public support and especially the quantified impact of investors through exposure to corresponding green bonds (Nordic Public Sector Issuers, 2019).

The fact that private companies are also becoming increasingly involved in the issue of climate-friendly investments and financing alternatives via green bonds is illustrated by the example of Apple Inc., which in June 2017, in the wake of President Donald Trump's withdrawal of the United States from the Paris Agreement (COP21), committed itself to investments via a 1 billion USD Green Bond to cover the financing effort required to convert the entire facility as well as the entire supply chain to renewable energy and energy efficiency through these bonds (Flammer, 2021).

2.8. Green Bonds and „Greenwashing“

Based on the dynamic growth in issuance and the overall market for green bonds, it is evident that the investment segment has established itself and is on its way to mainstreaming. However, the quality of governance in green bonds will be crucial in the long term. The existing possibility of greenwashing, especially given an internal validation of the issuers or even the banks that underwrite these green bonds, could cause reputational damage to the segment. Therefore, the currently still insufficient monitoring and prevention of greenwashing must be expanded.

The current prevailing regulatory framework enables greenwashing and makes it easier for companies to circumvent their private governance obligations. Overall, greenwashing poses a major threat to the stability of the green bond market by calling into question the reliability of mutual obligations of market participants. In doing so, iterative greenwashing would lead to questioning confidence in the regulatory framework as a whole and monitoring as well as compliance with commitment. Below are several potential greenwashing scenarios (KPMG, 2015):

Contrary to the original presentation, the financing proceeds are not allocated to environmentally friendly projects.

The issuer's core business is not sustainable and contradicts environmentally friendly behavior.

The use of financing proceeds is not verified and not reported transparently.

Overall, there is no evidence that the investment has resulted in an environmental improvement.

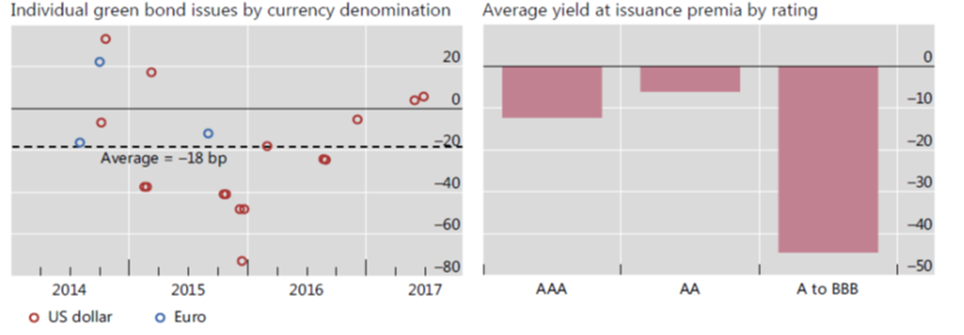

On top of the reputational risk on the one hand, there may also be a "green default risk" - also described as litigation risk. Morgan Stanley has classified the corresponding risks in ESG bonds as follows.

Figure 3. “Sector Risk Factor Weightings”.

Source: Morgan Stanley Investment Management, 2019.

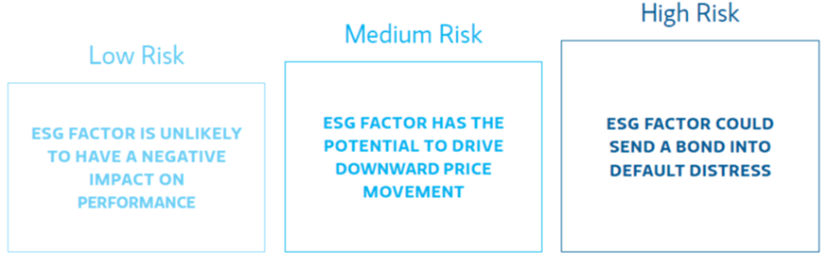

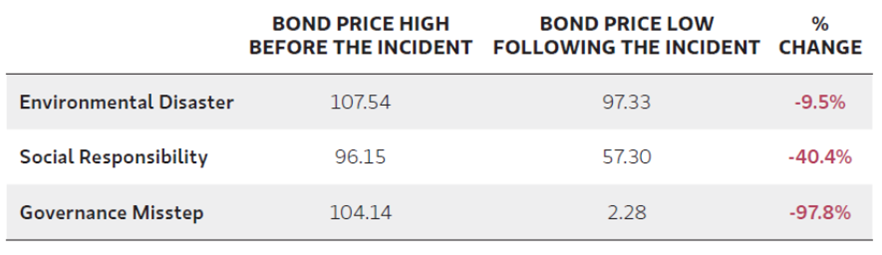

As an example, the significant losses in the event of a breach of the corresponding sustainability criteria are shown using three bonds. The risk of loss in the event of a breach of GBPs ("environmental disaster") is significantly lower than in the event of a breach of governance or social misconduct. Overall, however, the loss of around 10% is considerable.

Figure 4. Examples of Company ESG Incidents

Source: Bloomberg, Morgan Stanley Investment Management, 2019).

(Note: Each row of data represents one company, as an example, that experienced the ESG incident described. The bond price before and following the incident represents one individual bond that was issued by the respective company taken at the peak bond price right before the incident was made public and at the trough bond price following the incident).

Green bond market critics complain that private-sector standards are not sufficient and call for binding regulatory definitions. Currently, the standards and approaches are not very stringent, which reinforces the market participants' call for tighter regulation. In particular, nongovernmental organizations criticize a lack of inclusivity and the intensification of current private governance systems, here with a focus on sharpening GBPs. The criticism is primarily aimed at the fact that there is too much scope for environmentally damaging greenwashing in private governance standards and that this is also the cause of greenwashing. The establishment of a legally defined and compulsory regulatory framework could reduce or largely eliminate the opportunities for greenwashing through regulatory arbitrage (WWF, 2016).

3. Conclusion

Based on the current state of science and research on Green Bond issuance, it can be concluded that the majority of projects financed through Green Bonds would have been implemented even if the form of financing had not been a Green Bond. For this reason, green bonds still play a minor role in financing the low-carbon transition - they tend to have a supportive effect. Overall, it could not be established that higher net investments resulted with the introduction of the Green Bond segment, as many issuers would have had easy access to finance regardless (high credit rating, reputation, strong economic power).

The development of the market for Green Bonds is, nevertheless, dynamizing from a niche product into a financial instrument accepted by the broad range of market participants. The decisive factor here is that the risk/return profile of green bonds remains roughly congruent with conventional bonds. Currently, most investors, primarily institutional investors such as pension funds and insurance companies, are not willing to pay a "green premium" when investing in Green Bonds. The most important aspect for Green Bonds must be that they reduce the cost of capital due to their link to a carbon neutral and thus more environmentally friendly economy, and therefore also give smaller issuers the opportunity to obtain financing for this market. In the future, it must be ensured that the different expectations of investors and borrowers are brought together and lead to a sustainable and coherent value chain. If Green Bonds enable a low-carbon transition, there is an interest for both market participants and public policy makers to close this interest gap.

Regardless of the fact that there is currently little evidence that green bond issuers offer better conditions than regular bonds, the increasing demand from sustainable investors has the potential to lower their cost of capital (KPMG 2015). As demand for sustainable and green investment products increases, conditions for issuers would improve further. For this to happen, however, it must be ensured that investors give priority to climate-neutral and climate-friendly financial products. The willingness of investors to formulate clear and long-term green goals then leads to the distinction between sustainable and environmentally friendly investments becoming transparent compared to conventional investment vehicles.

Also, access to the bond market for smaller and riskier green projects could reduce the cost of capital. Since a large proportion of the necessary carbon-reducing financing projects involve SMEs or private sector clients, they have so far been financed through the traditional banking system.

With this market access for green bonds, demand could be met and would be more appropriately matched to the real needs of the economies - overall, this would also lead to an overall market revival. Another positive aspect would be the pooling of individual risks and thus the reduction of the overall risk, which would lead to a decrease in the capital costs.

Currently it is still too early to speak of success or failure with Green Bonds. Overall, the growth rates in issues show that the asset class is on the offensive and investors are expanding their investments - also due to the stronger orientation towards climate-friendly investments (impact investing). The coming years will show whether Green Bonds will develop into an elementary asset class and represent an essential building block in the portfolios. Market liquidity and transparency are crucial for this. However, it can be assumed that political pressure will increase and that green bonds will prevail.

References

- Barclays, Credit Research (Ryan Preclaw and Anthony Bakshi) 18th of September 2015. The Cost of Being Green [online] Available at: https://www.environmental-finance.com/assets/files/US_Credit_Focus_The_Cost_of_Being_Green.pdf [Accessed on 31 July 2021].

- Bultheel, C., Morel, R., Hainaut, H., Deheza, M., Shishlov, I., Depoues, V. and Leguet, B., 2015. COP21 – success at ‘the end of the beginning. Climate Brief #38, (Paris: I4CE - Institute for Climate Economics, December 2015).

- CBI, 2015. Bonds and Climate Change, The State of the Market.

- Clapp, C., Alfsen, K.H., Lund, H.F. and Pillay, K., 2015. Green bonds and environmental integrity: Insights from cicero second opinions. Nature Climate Change, 5, Insight from CICERO Second Opinions, Oslo: CICERO. [online] Available at: https://cicero.oslo.no/en/posts/news/green-bonds-and-environmental-integrity [Accessed on 28 July 2021].

- Cochu, A., Glenting, C., Hogg, D., Georgiev, I., Skolina, J., Eisinger, F., Jespersen, M., Agster, R., Fawkes, S. and Chowdhury, T., 2016. Study on the potential of green bond finance for resource-efficient investments. European Commission Report.

- Ehlers, T. and Packer, F., 2017. Green Bond Finance and Certification. Bank for International Settlements, Quarterly Review. [online] Available at: https://www.bis.org/publ/qtrpdf/r_qt1709h.pdf [Accessed on 30 July 2021].

- Flaherty, M., Gevorkyan, A., Radpour, S. and Semmler, W., 2017. Financing climate policies through climate bonds–A three stage model and empirics. Research in International Business and Finance, 42, pp.468-479.

- Flammer, C., 2021. Corporate green bonds. Journal of Financial Economics, 142(2), pp.499-516.

- Kane, S. and Shogren, J.F., 2000. Linking adaptation and mitigation in climate change policy. In Societal adaptation to climate variability and change (pp. 75-102). Springer, Dordrecht.

- KPMG, 2015. Gearing up for Green Bonds. [online] Available at: https://www.kpmg.com/Global/en/IssuesAndInsights/ArticlesPublications/sustainable-insight/Documents/gearing-up-for-green-bonds-v2.pdf [Accessed on 17 July 2021].

- Mackenzie, C. and Ascui, F., 2009. Investor leadership on climate change: an analysis of the investment community's role on climate change, and snapshot of recent investor activity.

- Morgan Stanley Investment Management, 2019. Driving Value in Fixed Income Through ESG. Morgan Stanley Investment Management. [online] Available at: https://www.morganstanley.com/im/publication/insights/investment-insights/ii_drivingvalueinfixedincomethroughesg_us.pdf [Accessed on 30 July 2021].

- Nordic Public Sector Issuers, 2019. Position Paper on Green Bonds Impact Reporting, Stockholm January 2019.

- OECD, 2015. Mapping Channels to Mobilise Institutional Investment in Sustainable Energy, Green Finance and Investment. OECD Publishing, Paris [online] Available at: https://www.oecd.org/g20/topics/energy-environment-green-growth/mapping-channels-to-mobilise-institutional-investment-in-sustainable-energy-9789264224582-en.htm [Accessed on 30 July 2021].

- Ostlund, E., 2015. Are investors rational profit maximisers or do they exhibit a green preference. Evidence from the green bond market. Stockholm School of Economics master’s thesis in economics (21875), Stockholm.

- Petrova, A., 2016. Green bonds: lower returns of higher responsibility?. Radboud University, Nijmegen School of Management.

- Shishlov, I., Morel, R. and Cochran, I., 2016. Beyond transparency: unlocking the full potential of green bonds. Institute for Climate Economics, pp.1-28.

- Wilkins, M., Shipman, T. and Wade, T., 2016. The Corporate Green Bond Market Fizzes as the Global Economy Decarbonizes. Standard & Poor’s. April, 15, p.2016.

- World Bank Green Bond Impact Report 2018, “10 Years of Green Bonds – From Evolution to Revolution”, (Washington: International Bank for Reconstruction and Development, 2018).

- Wulandari, F., Schäfer, D., Stephan, A. and Sun, C., 2018. Liquidity risk and yield spreads of green bonds.

- Krimphoff, J., Charmann, S., Clucas, N., Emfel, M., Favier, A. and Godinot, S., 2016. Green bonds must keep the green promise! A call for collective action towards effective and credible standards for the green bond market. WWF. Paris. [online] Available at: https://d2ouvy59p0dg6k.cloudfront.net/downloads/20160609_green_bonds_hd_report.pdf [Accessed on 30 July 2021].

- WWF, 2016. Green Bonds must keep the Green Promise. Call for Collective Action towards effective and credible Standards for the Green Bond Market, research report produced by WWF in collaboration with Group Caisse des Dépots and CBI, 2016. [online] Available at: https://d2ouvy59p0dg6k.cloudfront.net/downloads/20160609_green_bonds_hd_report.pdf [Accessed on 30 July 2021].

- Zerbib, O.D., 2019. The effect of pro-environmental preferences on bond prices: Evidence from green bonds. Journal of Banking & Finance, 98, pp.39-60.

Article Rights and License

© 2021 The Authors. Published by Sprint Investify. ISSN 2359-7712. This article is licensed under a Creative Commons Attribution 4.0 International License.